Here’s our brief guide to help you through the myriad of decisions you need to make when applying for a mortgage. If it’s your first mortgage, the number of things to consider can initially appear quite daunting – hopefully this guide should help you through it. But even if it’s not your first mortgage, this should still serve as a useful checklist. Above all else, thinking more carefully about every aspect before you commit to a mortgage is time well spent and it could save a lot of stress later down the line. As with anything mortgage related – if in doubt, please just ask us here at Mortgagez. We’re always happy to help and have a wealth of experience when it comes to finding you the right mortgage (even when others have failed!).

Top 10 things to consider when applying for a mortgage:

- Mortgage advice pays

- Your budget

- The market

- Your credit score

- The difference your deposit can make

- Different types of mortgages

- Existing debts/commitments

- Your job/income security

- Stamp duty

- The cost of moving

- Mortgage advice pays

The first and foremost thing to remember when applying for a mortgage is that professional mortgage advice can really pay off when it comes to finding you the smartest mortgage deal. At Mortgagez we don’t charge a penny for our service when you use our portal – it’s completely free as we are paid by the lender; not you. Our aim is to find you the best mortgage deals from across the whole of the market, saving you both time and money. We can also offer you a range of independent solicitor options via our portal with integrated application tracking from start to finish so that everything you need for your mortgage is all under one roof.

2. Your budget

Some experts suggest that the total amount that you pay towards your mortgage should not exceed 28% of your gross income (before tax and national insurance contributions). Coupled with this, you should make sure you don’t go over 36% of your gross income for the total amount you spend on all borrowing (including your mortgage). What this in effect means is that you should not be spending more than about a third of your gross income on your mortgage, credit cards or car finance payments. Although monthly mortgage payments tend to be lower than rent, it’s also important not to forget about additional monthly outgoings you may not have had before becoming a homeowner, things like: buildings and contents insurance, utility bills and council tax along with life insurance and income protection, not to mention any maintenance costs on the property itself. So, if you haven’t already, start a spreadsheet noting down all the items you can think of with estimates for those you don’t know the exact figure for yet. Planning what mortgage you can afford now could pay off in the long run.

3. The market

The market, though out of your control, is a hugely important factor to consider when applying for a mortgage. Not only for the impact it has on rates and mortgage costs, but for the future value of your property – nobody wants to find themselves in negative equity (where your property is worth less than the amount you owe on your mortgage). However, for most people buying a property is a long-term commitment so try not to get too caught up in the highs and lows of the property market.

4. Your credit score

Using one of the three main credit referencing agencies (Experian, Equifax and TransUnion), it’s never been easier to check your credit score. If you’ve never checked your own credit score you should definitely look to do this before applying for a mortgage. Often there’s a free trial available so you shouldn’t even need to pay for this. Also to bear in mind is that your score can vary across the credit reference agencies so if one is okay the other two might not be. It is also worth speaking to your mortgage adviser about quick ways to improve your credit score before you apply for a mortgage. Tying up loose ends and generally spring cleaning your finances could save you thousands of pounds in the long run by ultimately enabling you to secure a better rate on your mortgage.

5. The difference your deposit will make

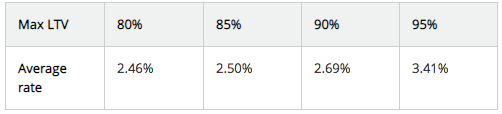

A bigger deposit will normally result in lower payments, as there is a smaller loan to pay off (and hence a smaller loan-to-value (Loan-to-value or “LTV” as it’s often referred to as, is the ratio between the property value and the loan you are taking out against it). However, there are a few additional factors worth considering when it comes to your deposit, especially for first time buyers. Lower LTVs can usually help to secure a better rate but the difference it makes does depend on how big your deposit is. So, if you have saved up enough for a 5% deposit, it may be worth holding off until you have say a 10% deposit to help you get that better mortgage deal. Below is an example of how rates can differ when the LTV changes:

So in the examples shown in the table above, an LTV of 80% (i.e. where there is a 20% deposit and an 80% loan against the property) the average rate could be around 2.46%. Only save for a 5% deposit and the average loan rate could be almost a percentage point higher at 3.41%. Also worth considering is that by not using all of your available capital as a deposit, the remaining money could be put to work by gaining interest, a return from investment funds or even used to carry out essential renovations to the property (which may then add value to your property). Again, we would always suggest talking to a mortgage adviser or financial professional to find out the best way to make your money work for you when choosing a mortgage.

6. Different types of mortgages

There are many products out there to suit the needs of all types of customers, whether you’re a first time buyer, co-applicants, professional landlords, homemovers or just remortgaging. A choice almost every mortgage applicant will have to make is whether you prefer a fixed or variable rate product. Fixed rates tend to be more expensive but give the buyer peace of mind that the monthly payments will not change for the predetermined term. Variable rates move with the market so if rates are low this option can initially appear cheaper than a fixed rate but there is clearly more risk if you are on a tight budget and rates start increasing. Here at Mortgagez we can run through all of your mortgage requirements to advise you on the most suitable product for your circumstances. Our service is fee-free when you go via our portal. For more detail on mortgage types also see our Guide: Fixed rate or standard variable rate?

7. Existing debts/commitments

The main thing to consider here is that if you have any existing loans, car hire/purchase agreements or credit card debts, these will be taken into account by the lender when looking at your application. More often than not, the amount they total will be deducted from the overall amount you can borrow. You will also be asked to detail your existing outgoings so if you are paying things like school fees these will also be taken into account by the lender. So keep these items to a minimum and try not to rack up large credit card balances or take out any non-essential loans just before you apply for your mortgage as this could affect your chances of obtaining a mortgage.

8. Your job/income security

It is fair to say that job security is not what it once was. Unexpected events such as losing your job through redundancy or ill health can all tip the balance when it comes to covering your commitments and outgoings. Often such situations are unavoidable and beyond our control but it’s sensible to think about the ‘what-if’ of these scenarios and what you would do should they happen. Keeping a ‘cushion fund’ or ‘nest-egg’ tucked away for emergencies can give some peace of mind and the figure often quoted is equivalent to 3-6 months’ income. However, not everyone is able to do this so it might be worth considering other forms of income protection or insurance. Your mortgage adviser should be well-versed in this area and at Mortgagez we are always happy to talk you through the various options that are available to you.

9. Stamp duty

For those of you who are physically moving, stamp duty also needs to be factored in – officially known as stamp duty land tax or SDLT, it’s paid on any property purchase of more than £125,000 and paid to the HMRC by the solicitor acting on your behalf. There are plenty of stamp duty calculators to explore online and it’s important to factor this cost into your overall budget plan in order to ensure that you have enough funds to pay it. For the HMRC stamp duty calculator please use the following link:

https://www.tax.service.gov.uk/calculate-stamp-duty-land-tax/#/intro

10. The cost of moving

Obviously when remortgaging an existing property it’s not relevant to consider moving costs but if you are a first time buyer or home mover, the cost of the move itself is a surprisingly easy thing to overlook when applying for a mortgage. Unless you are planning to move yourself and have your own suitable transport, it’s not usually until you’ve found a property and are about to exchange that you need to find a removals company. It is essential that you have a removals slot reserved so you can agree on a move date with the other parties. So rather than leave it until the last minute and be caught out by this cost, it’s worth checking out moving costs and typical availability well before you need to book and it could save you money in the long run.

For an up-to-date view, why not compare and secure the best mortgage deal for you TODAY by completing a quick quote online and seeing how much money you could save.

YOUR HOME MAY BE REPOSSESSED IF YOU DON’T KEEP UP REPAYMENTS ON YOUR MORTGAGE

Any guidance and/or advice contained within this document is subject to the UK regulatory regime and is therefore restricted to consumers based in the UK. Any technical or regulatory information contained within this document was correct at the time of producing it but as it may be subject to change it should not be exclusively relied upon when making a financial decision. The Financial Conduct Authority does not regulate advice on Buy to Let mortgages.

Article written: June 2020 080620 MZ000117